Luxon Pay: A Comprehensive E-Wallet Analysis of Features, Benefits, and User Experience

Luxon Pay, established in 2018, has rapidly emerged as a prominent player in the digital wallet and financial services sector, particularly catering to the needs of online gamers and poker players. This in-depth article explores the various aspects of Luxon Pay, including its personal features, customer support, fee structure, specific benefits for poker players, and the onboarding process.

How to open your Luxon Pay Account in minutes

Step 1: Prepare Required Information and Documents

Before starting the account creation process, ensure you have the following ready:

- Personal Information:

- -Full name

- -Date of birth

- -Country of residence

- -Email address

- -Phone number

- Government-issued photo ID:

- -Passport, driver’s license, or national identity card

- -Note: Birth certificates and handwritten documents are not accepted 1

- Proof of address (may be required):

- -Recent utility bill, bank statement, or tax assessment (dated within the last 3 months)

- -Must be clearly legible

Step 2: Download the App or Access the Web Platform

Choose one of the following options:

- -Download the Luxon Pay app from the Google Play Store (for Android devices)

- -Download the Luxon Pay app from the App Store (for iOS devices)

- -Access the Luxon Pay web platform on your computer at www.luxon.com

Step 3: Begin the Registration Process

- Open the Luxon Pay app or website

- Click on the “Sign Up” or “Create Account” button

- Enter your email address

- Check your email for a 6-digit verification code from LuxonPay

- Enter the verification code in the app or website to proceed

Step 4: Provide Personal Information

Fill in the required personal details:

- -Full name

- -Date of birth

- -Country of residence

- -Create a secure password for your account

Step 5: Identity Verification

- Click on the “Verify your Identity” button in your account

- Select “Verify now” in the mobile app

- Follow the prompts to upload a photo of your government-issued ID

- Take a selfie using your mobile device to complete the identity verification process

Step 6: Additional Verification (if required)

If prompted, provide additional documents such as:

- -Utility bill

- -Bank statement

- -Tax assessment Ensure these documents are recent (dated within the last 3 months) and clearly legible

Step 7: Wait for Verification Approval

- -The verification process can take up to 24 hours

- -You will receive a push notification upon logging in once verified

- -Check your account status under ‘Account’ and ‘Account information’

Step 8: Link Your Bank Account

Once your account is verified:

- Log into your Luxon Pay account

- Look for an option to “Link External Accounts” or similar

- Provide your bank’s routing number and your account number

- Complete any additional verification steps required by Luxon Pay

Step 9: Deposit Funds

After linking your bank account:

- Choose the “Deposit” or “Add Funds” option in your Luxon Pay account

- Select your preferred deposit method (Cryptocurrencies, Bank transfer, Visa & Mastercard)

- Follow the prompts to complete the deposit

Personal Features and User Experience

Luxon Pay offers a range of personal features designed to provide a seamless and user-friendly experience for its customers:

Multi-Currency Digital Wallet

At the core of Luxon Pay’s offering is its multi-currency digital wallet. This feature allows users to hold and exchange over 30 currencies instantly, making it an ideal solution for individuals who frequently engage in international transactions or travel.

The ability to manage multiple currencies in one place simplifies the process of converting and transferring money across different currencies, providing users with greater financial flexibility.

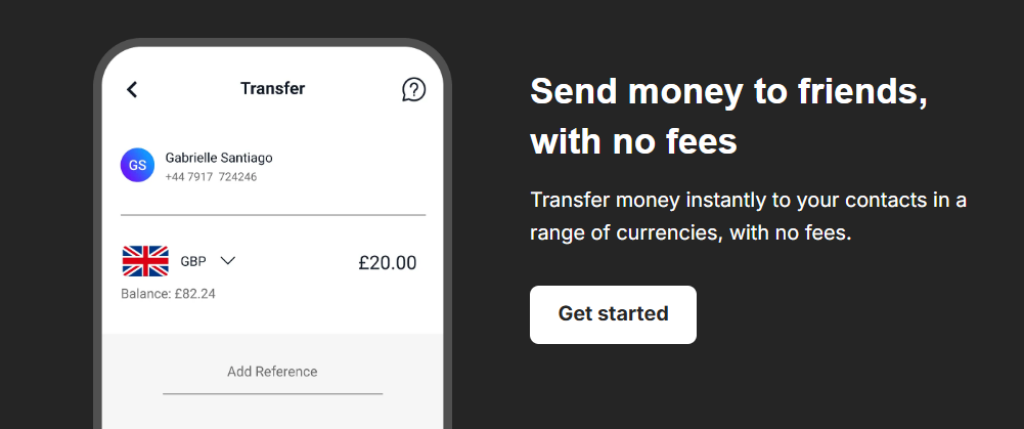

Instant and Fee-Free Transactions

One of the most attractive features of Luxon Pay is its commitment to fee-free transactions. Users can send and request money from friends globally without incurring any fees, which is particularly beneficial for those who frequently make international transfers. This feature sets Luxon Pay apart from many traditional financial institutions that often charge significant fees for such services.

User Interface and Accessibility

Luxon Pay has invested considerable effort in improving its user interface and overall accessibility. The app features a clean and easy-to-navigate design, developed with a focus on inclusivity. This includes avoiding color schemes that may be challenging for colorblind users and maintaining appropriate text sizes to ensure clarity. The result is a platform that is not only visually appealing but also functional for a wide range of users.

Cross-Platform Consistency

Recognizing the importance of a seamless experience across devices, Luxon Pay has ensured consistency in its user interface and functionality across both mobile and desktop platforms. Users can expect similar layouts and features, including the ability to return to the dashboard with a single click from any transaction screen. This consistency enhances user experience by allowing for smooth transitions between devices.

VIP Program

Luxon Pay offers a VIP program that rewards frequent users with enhanced features and services. As users progress through the VIP tiers by meeting certain deposit targets at online merchants or live venues, they unlock additional benefits, which can include reduced fees and higher transaction limits.

Customer Support

Luxon Pay prides itself on offering comprehensive customer support to ensure users can always access assistance when needed:

24/7 Availability

One of the standout features of Luxon Pay’s customer support is its round-the-clock availability. This ensures that users can access assistance at any time, regardless of their time zone or location, which is particularly valuable for a service catering to a global user base.

Multiple Contact Methods

Luxon Pay offers several ways for users to reach out for support:

- Live Chat: Highlighted as the fastest and easiest way to contact support, the live chat feature is available 24/7. Users can typically connect with a support agent within minutes by clicking the small circle at the bottom right of the Luxon Pay website.

- Email Support: For less urgent inquiries, users can reach out via email. It’s recommended to use the email address associated with the user’s account to facilitate identity verification and expedite the resolution process.

- Direct Contact: Users have the option to talk directly to a member of the Luxon Pay team through the chat feature on their website.

Response Times

While specific response times for email inquiries are not detailed, the availability of 24/7 live chat suggests that immediate assistance is prioritized. The live chat typically connects users with a support agent within a few minutes, indicating a quick response time for urgent queries.

Additional Support Resources

To complement its direct support options, Luxon Pay provides a detailed FAQ section on their website. This resource can be valuable for users seeking answers to common questions without needing to contact support directly.

Fee Structure and Costs

Luxon Pay has designed its fee structure to be competitive and transparent, with a focus on minimizing costs for users:

Basic Transactions

For standard transactions, Luxon Pay maintains a no-fee policy. This includes:

- -Sending money to other Luxon users

- -Receiving money from Luxon users

- -Depositing money into a Luxon account

Withdrawal Fees

Withdrawals to UK bank accounts in GBP and SEPA bank accounts in EURO are free. For international withdrawals:

- -Bronze VIP level users get one free withdrawal per calendar month, with a 1.99% fee applied thereafter.

- -Premium VIP members do not incur additional fees on withdrawals.

Currency Exchange Fees

Luxon Pay offers currency conversion at spot rates, providing users with current market prices for conversions:

- -Bronze VIP members enjoy free currency exchange up to €1,000 per month, with a 1.99% fee applied thereafter.

- -Higher-tier VIP members benefit from reduced or eliminated fees for currency exchanges.

SWIFT Bank Withdrawals

There is a €20 fee for SWIFT bank withdrawals for standard users, which is waived for higher-tier VIP members.

ATM Withdrawals and Spending Abroad

- –ATM withdrawals incur a 1% fee across all VIP levels.

- -Spending abroad fees decrease with higher VIP levels, starting at 2% for standard users and reducing to 0.5% for Noir VIP members.

VIP Program and Fee Reduction

Luxon Pay’s VIP program offers a structured way for users to reduce costs through increased usage and engagement with the platform. As users progress through VIP tiers, they can benefit from reduced or eliminated fees for various services.

Benefits for Poker Players

Luxon Pay has tailored its services to cater specifically to the needs of poker players, offering several unique benefits:

No Transaction Fees

The absence of transaction fees is particularly beneficial for poker players who frequently deposit and withdraw funds, making the process more cost-effective.

Peer-to-Peer Exchange

Luxon Pay’s fee-free peer-to-peer exchange service allows poker players to transfer money quickly and without additional costs, which is crucial in the fast-paced world of online poker.

Integration with Poker Events

Luxon Pay is integrated into live poker events, enabling players to exchange currency and buy into these events instantly. This feature streamlines the process for poker players participating in live tournaments.

Developed by Poker Players

The platform is developed by poker players for poker players, ensuring that the features and services are aligned with the specific needs of the poker community. This includes quick, safe, and efficient deposit options.

VIP Benefits

Poker players can take advantage of various VIP benefits, such as free spot rate currency exchange for Bronze VIP members up to a certain limit, which can be particularly useful for high-stakes players.

Increased Limits

For those achieving higher statuses, such as Noir status, Luxon Pay offers increased limits on peer-to-peer transfers, deposits, and withdrawals. This feature is particularly beneficial for poker players dealing with large sums of money.

es, it is likely to remain a significant player in the digital wallet and financial services sector, particularly for those in the online gaming and poker communities.